The Tax Cuts and Jobs Act of 2017 is the most significant change to the tax code in 30 years. Most of the individual tax laws are not permanent and will expire in 2025, which is noted. Here is a quick summary of the changes that will affect your taxes beginning in 2018.

1. Tax brackets

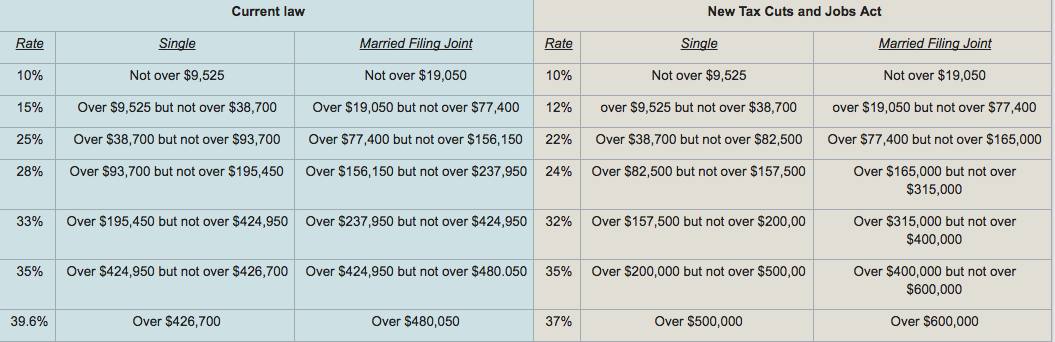

There will remain 7 tax brackets, as before, but each bracket is now at a lower rate. The new brackets are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Below is the breakdown of current vs. new for 2018.

The only big losers here are those single individuals in the old 33% tax bracket who now find themselves in the 35% tax bracket. It also applies to the upper reaches of the MFJ filers in the 33% tax bracket in the current. They too end up in the 35% tax bracket in the new bill.

*Expires 12/31/25

2.Standard Deduction

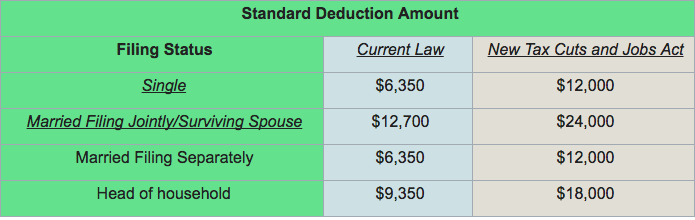

The Tax Cuts and Jobs Act significantly increases the standard deduction:

The number of taxpayers who choose to itemize will drop since the only reason to do so is if your deductions are more than your standard deduction.

*Expires 12/31/25

3. Elimination of the personal exemption

A personal exemption is allowed for yourself, your spouse, and all of your dependents. For 2017, the amount deductible for each personal exemption is $4,050. Added to either the applicable standard deduction or itemized deductions, they help to reduce taxable income.

In 2018, personal exemptions will be a thing of the past. If you have 3 or more family member, this could offset or even negate any tax reduction you’ll receive from other tax provisions.

For example, in a family consisting of you, your spouse, and one child, under the old rules, your standard deduction was $12,700 + $12,150 (personal exemption $4,050 x 3 family members) = $24,850 total deductions. In the new tax bill, your deduction is now $24,000, $850 less. It gets considerably worse for each additional family member above three in this scenario.

The bottom line: The larger your family, the more deductions you lose with the Tax Cuts bill.

*Expires 12/31/25

4. $10,000 limit on state and local income tax and property tax combined deductions

The good news, the Tax Cuts bill will maintain the state and local income and property tax deductions for those who itemize. The bad news, it will cap the amount you may deduct at $10,000. Currently, the deduction is unlimited.

The new bill doesn’t limit property taxes to $10,000 and state and local income taxes to $10,000, it combines property, state, and local income taxes to a $10,000 limit.

This change, depending on your state, county, and municipality could have a significant negative impact on your taxes. What I do think we’ll see is a shift of taxation from one type to another in those areas affected to help out taxpayers.

*Expires 12/31/25

4. Expanded child tax credit

The credit is doubled from $1,000 to $2,000 for children under 17. Also, the income phase-out levels are increased significantly:

Single Parents: $200,000, up from $75,000 currently

Married Parents: $400,000, up from $110,000 now

Also, the first $1,000 of the child tax credit and $400 of the additional $1,000 will be refundable, meaning those whose tax liability is zero will still get the credit refunded to them.

The child tax credit will offset some of the personal exemption elimination, at least until your children are 17.

*Expires 12/31/25

5. Credit for dependents that do not qualify as children

The new rules allow parents to take a $500 credit for dependents who do not qualify as children (dependents under 17). The credit applies to a dependent you’re supporting such as a child 17 or older, a parent, or an adult child with a disability. The new qualifying dependent credit is subject phase-out rules.

*Expires 12/31/25

6. Itemized deduction limitation eliminated

Also called the Pease rule, the itemized deductions limit phases out specific deductions once income for 2017 exceeds either $261,500 (single) or $313,800 (MFJ).

When applied, the total of your itemized deductions is reduced by the lesser of:

3% of AGI above the applicable threshold; or

80% of the amount of itemized deductions otherwise allowable.

*The Pease rule returns on 12/31/25

7. Mortgage interest deduction capped at the first $750,000 of debt

Beginning December 15, 2017, you will only be able to deduct the mortgage interest on the first $750,000 taken out on a first or second home, down from $1 million today. If you already have a mortgage before that date, you are still eligible to deduct mortgage interest up to $1 million. You will also be grandfathered in if you are under contract to purchase a home by 1/1/18 and close on it by 4/1/18.

*Expires 12/31/25

8. New rules for home equity loans

Over the past 25 years, using the equity in your home for anything other than your home is has become a standard practice. Those days are over! The new tax bill will no longer allow a deduction for the interest on home equity loans not used for acquisition indebtedness.

Taken right from the bill…

“Acquisition indebtedness is indebtedness that is incurred

in acquiring, constructing, or substantially improving a

qualified residence of the taxpayer and which secures the

residence.”

Currently, home equity interest not used for acquisition or improvement is deductible on loans up to $100,000. Not only will that no longer be allowed in the future, but any existing home equity loan interest will also no longer be deductible.

Bottom line: The key will be the distinction between acquisition indebtedness, used to purchase or improve a home, and home equity indebtedness, when the equity is used for tuition, or to pay off credit cards, etc.

Acquisition indebtedness = deductible

Home equity indebtedness = not deductible

*Expires 12/31/25

9. Adios miscellaneous itemized deductions

Which ones are they? The itemized deductions such as tax preparation fees, investment advisory fees, safety deposit box fees, and unreimbursed employee business expenses, just to name the most common.

Gone, eliminated, repealed – no deduction for you!

10. Reduced medical expense deduction limit

This reduction is only good for 2017 and 2018. The 10% of AGI threshold for medical expense deductions is reduced to 7.5% of AGI for both 2017 and 2018. In 2019, the limit goes back to 10% of AGI.

*Expires 12/31/18

11. 529 plan changes

529 plan funds can now be used, tax-free, of course, for K-12 costs, up to $10,000 per student. That applies to public, private, or religious schools. Previously, 529s could only be used to cover costs for college.

Also, homeschooling expenses will be covered by 529 plan distributions. The $10,00 per student limit also applies. All educational materials, tutors, and therapies are covered.

12. ABLE account changes

The Tax Cuts and Jobs Act now provides the ability to roll 529 plan assets into an ABLE account. As long as both accounts have the same beneficiary or a member of the same family, you can roll over up to the annual gift exclusion amount, which is $15,000 in 2018.

Also, the beneficiary will now be able to make their own contributions above the contribution limit if they have earned income. The maximum amount is the lesser of 100% of their compensation, or the federal poverty line threshold for a one-person household. They cannot contribute to a 401(k), 403(b), or 457(b) plan at the same time.

ABLE accounts are designed for use by people with disabilities and their families. Now those families have more flexibility when it comes to funding an ABLE account.

13. Roth conversion recharacterization elimination

This one bothers me. Currently, Roth conversions can effectively be recharacterized. A recharacterization means you could change your mind and revert the Roth conversion to a traditional IRA (or 401(k), etc.). It was an allowed do-over.

The ability to recharacterize was to avoid unnecessary taxes during a conversion in case the amount converted pushed you into a higher tax bracket or caused a reduction in credits or deductions. It was handy because calculating your tax situation and outcome when doing a conversion in December is often difficult for many taxpayers. The recharacterization gave them some peace of mind knowing that we could adjust to get the most efficient tax benefit.

Beginning in 2018, the Tax Cuts and Jobs Act eliminates the ability to recharacterize Roth conversions. Don’t worry, conversions completed in 2017 are still permitted to be recharacterized by April 15, 2018. Also, Roth contributions will retain their recharacterization rules.

This will require a more conservative approach to Roth Conversions.

14. 20% business income deduction for pass-through entities

Pass-through business entities are partnerships, LLCs, S corporations, or sole proprietorships taxed at the individual level. In English, the business income and expenses pass from the business to the individual(s). So if you are a business owner and file Schedule C – you’re a pass-through entity.

Owners of pass-throughs will be able to deduct 20% of their qualified income if they make less than $157,500 filing singly or $315,000, married filing jointly. The deduction is phased out above those thresholds

Before you run out and change your company structure to a pass-through entity, there are restrictions – many restrictions. Contact us before you do anything rash.

15. For all intents and purposes, the estate tax and gift taxes have been repealed

They haven’t truly been repealed, but they will apply to such a small percentage of taxpayers that they are practically repealed. Currently set at $5.49 million for individuals and $10.98 million for married couples, the new tax plan doubles the exemption amounts to $11.2 million for individuals and $22.4 milion for married couples.

You can’t die before 12/31/17 to have your heirs enjoy the new exemptions though, so eat your vegetables and forego skydiving for another week.

*Expires 12/31/25

16. You can no longer deduct alimony payments.

*Expires 12/31/25

17. You can no longer deduct moving expenses

*Expires 12/31/25

These are the ones that will have the most significant impact. I could go on with many more changes. There are so many changes to our tax code, that how these tax cuts will play out will not be known until everyone files their taxes for 2018. I guarantee there will be loopholes (don’t worry, I’m lookin’) and unintended consequences – good and bad.

The difficulty is determining how the tax cuts and changes will interact with each other. We can talk about that in the winter and spring of 2019.

Here is where I usually say if you know someone who could benefit from this post, please feel free to share. I can confidently say every taxpayer will benefit from reading this post. Please share with the handy, dandy buttons below.