You’re probably familiar with the concept of refinancing your mortgage, the process of getting a new loan to lower your interest rate, monthly payment, or term. However, have you ever heard about recasting your mortgage? A mortgage recast is a method used to reduce your monthly mortgage payments and save interest, similar to a refinance, but avoiding the significant costs and headaches.

Why haven’t you heard of recasting?

Don’t feel bad. It’s not your fault. The mortgage companies don’t advertise recasting. They’d prefer you to refinance. Refinancing is where they make their money. That’s why you get bombarded with refinancing proposals. Have you ever received an offer to recast? I doubt it.

Recast vs. Refinance

While both recasting and refinancing a mortgage can lower your monthly payments and reduce the total interest paid, that’s where the similarities end.

When you refinance a mortgage, you’re applying for a brand-spankin’-new loan with a new term, interest rate, and monthly payment. Along with that application are the closing costs, appraisal, other fees, income verification, and credit checks. Refinancing is a pain-in-the-you-know-what!

On the other hand, when you recast your mortgage, you pay the lender a lump sum toward the principal. The loan is recalculated based on the new lower principal balance. The interest rate and term stay the same, but because your principal has decreased, your monthly payments will be lower, and you will save on interest over the loan’s life. There is a small fee, but it’s much less than refinancing, and you don’t have to jump through all the hoops required by refinancing!

Example

Your $325,000, 4.25%, 30-year mortgage has exactly 20 years left, a balance of $258,191, and future interest payments of $125,523. The monthly payment is $1,598.30. You have $25,000 left from a work bonus (It was a good year). If you put the $25,000 toward that remaining principal and asked your lender to recast the mortgage, your monthly payment would drop by $154, to $1,444. Total interest would drop to $113,369. That’s an interest savings of $12,154.

I know what you’re thinking, a lower payment and less interest. This is to be too good to be true. No, it isn’t, but there are a few caveats.

- Your mortgage company isn’t required to offer to recast. Since it’s almost impossible to find out if your mortgage lender allows recasting, you’ll need to give them a call.

- Minimum lump sum: Each lender has a different policy on the minimum lump sum to recast. It runs anywhere from $5,000 to $50,000.

- There is a small fee. I’ve found prices run from $100 – $500. I know small is relative, but that’s chump change compared to the cost of refinancing, which usually runs in the thousands of dollars. A typical closing cost fee is 1% of the loan. In my example above, 1% of $258,191 is $2,582.

- Some mortgages, such as Federal Housing Administration and Veterans Affairs loans, are not eligible for recasting.

When should you recast?

The lump sum

Recasting is out of the question if you can’t come up with a lump sum. Even if you have a lump sum available, there are other considerations. Did you max out your retirement savings? Is all of your other debt paid off? Is your emergency savings adequate? If the answer to those questions is yes, then recasting may be appropriate.

If you recast your mortgage but continue to carry credit card debt, you’re defeating the purpose of saving money. Before you recast, look at your overall financial health to determine if this is the best use of your cash.

The new home, old, home, no man’s land

You buy a new home but haven’t sold the old one. That probably results in the new home mortgage having a higher principal balance. You can use the proceeds from the previous home sale to recast the new mortgage and reduce your monthly payment.

Recasting instead of refinancing is handy in this situation. You just went through a costly closing. Unless interest rates have dramatically dropped between the purchase of the new home and the sale of the old, refinancing may be pointless and expensive.

Refinancing isn’t a good option

If your credit is less than ideal or interest rates are rising, then refinancing is probably not an appealing option. In fact, it may not even be the best financial move if you refi to a longer mortgage, say from 21 years left on your mortgage to a new 30-year loan. That’s 9 more years of interest payments!

What about just paying extra?

Let us revisit the age-old question about paying extra on the mortgage vs. investing that money elsewhere and adding recasting into the equation.

If you are financially sound with the previously mentioned items, no debt, substantial emergency savings, and maxing out retirement savings, you could invest even more instead of putting those funds toward your mortgage.

Yes, if you have a low-interest mortgage, you could invest better, but some people would rather have a root canal than debt. If that’s the case and it makes you feel better, then, by all means, put extra money towards the principal, whether recasting or additional principal payments.

Recast vs. Extra Payments

Let’s use the same example from above, 20 years left, 4.25%, and a balance of $258,191, with future interest payments of $125,523. Instead of recasting, you choose to pay $100 per month extra. So instead of $1,598.30, you are now paying $1,698.30 monthly. Total interest drops to $113,143, a $12,154 savings over the original mortgage terms, but only $226 savings compared to the recast, plus accounting for the $500 cost to recast (my estimate), so we’ll say $775 in savings.

Why are extra payments slightly better? It comes down to the fact that you are shortening the length of the loan. Remember, recasting doesn’t change that. Paying extra also doesn’t cost anything most time. Beware – some mortgages have early payoff fees.

Best of both worlds

What happens if you recast but keep the same monthly payment, essentially paying $144 extra monthly? I’m glad you asked.

Keeping with the same example, if you recast your mortgage with the $25,000 lump sum payment reducing the monthly amount from $1,598 to $1,444, keep paying the $1,598. You’ll reduce the total interest to $95,581 and the term from 20 years remaining to just under 19 years.

The process of elimination

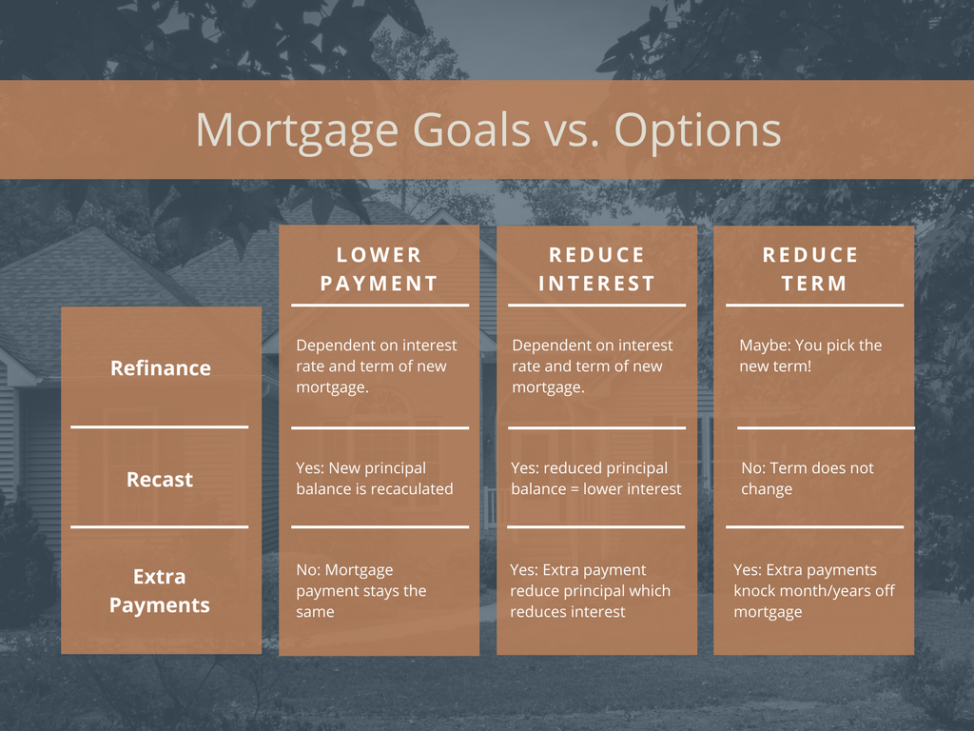

Most times, determining the best way to attack your mortgage requires you to compare what goal you want to accomplish…

- Lower your monthly payment.

- Pay your mortgage off early.

- Reduce the overall interest paid.

…with the best available principal reduction strategy, recasting, refinancing, or making extra principal payments. These goals are not mutually exclusive. In fact, your primary goal may also accomplish one of the other goals. Most of the time, the process of elimination will show which option is best to achieve your goals.

The mortgage recasting option

Recasting isn’t always going to be the best solution to meet your mortgage goals. You must analyze your financial condition, current interest rate climate, and goals to determine if you should refinance, make extra principal payments, or recast. The critical point is that you understand what recasting is! It’s not a stretch to say that most people are unaware of the ability to recast their mortgage. Knowledge is power.

Is recasting appropriate for you? We can help you get a financial plan to put you in a better financial position. Contact us to learn more.